Trends in Dentistry 2024

Overcoming challenges to profitability

Sefira Fialkoff

In 2024, the landscape of dentistry was marked by a delicate balance of challenges and opportunities. Inside Dentistry understands that keeping a finger on the pulse of the profession can help dentists to better develop and refine their strategies for success, both in the chair and at the desk. To that end, our annual "Trends in Dentistry" feature presents carefully collated data from readership surveys on various aspects of the profession, including those in the areas of practice management, clinical care, and purchasing and technology adoption.

This year, rising overhead costs, other economic pressures, and shifting patient expectations prompted dentists to reevaluate their strategies for profitability and growth. To remain competitive, many adopted new approaches to practice management, expanded service offerings, and invested in cutting-edge technology. Where does your practice stand, and what, if any, changes could you be making to protect and grow your business? A good place to start is by examining some of the current trends to get a handle on the state of the profession and glean insight into how clinicians are navigating the current challenges while continuing to prioritize the delivery of excellent patient care.

Practice Management

Although the number of respondents whose practices were in each of the top three income brackets declined since last year, the percentage who reported using a practice management consultant remained steady at 13%. "Overhead has increased due to staff compensation and inflation, especially with supply chain issues," says Roger Levin, DDS, founder and CEO of Levin Group, a practice management consulting firm. "Insurance companies aren't raising reimbursements, so even with increased production, profits have dropped." However, he notes that many practices who work with management consultants have been able to maintain steady net incomes. The right consultants can help practices identify pain points and offer personalized approaches that yield measurable results.

Whether practices receive outside help or not, their ability to adapt to realities in the market plays a critical role in the success of their operations. "Patients want options," explains Chad Duplantis, DDS, a private practitioner in Fort Worth, Texas. "This is true when they are making treatment decisions as well as when they are financing those decisions." Since last year, there were significant increases in the number of survey respondents who reported that they accept private dental insurance (85% to 89%), offer or accept alternative (ie, discount or membership) plans (37% to 47%), and connect patients with healthcare financing (60% to 63%), with alternative plans seeing the biggest jump. This shift may reflect efforts to boost profits by offering patients more flexible payment options. "One of the many reasons that patients look to switch practices is because their current office does not offer financing," says Duplantis. "Practices don't have to finance in-house-there are external lenders. Although some of these options can cost more than credit cards, they can be key to enabling patients to move forward with necessary treatment."

During a time when patients' budgets are so tight, offering as many payment options that are appropriate for a practice as possible seems prudent, but practices can also make changes to their workflows to make treatment more affordable. "We're getting more creative in helping patients afford treatment," says Andrew Johnson, DDS, MDS, CDT, a prosthodontist with a private practice in Fayetteville, Arkansas. "As an out-of-network provider, we use third-party lending and payment plans often, but we're also leveraging digital technology to lower traditional economic barriers to comprehensive dentistry."

Although the survey data regarding total new patients treated per month remained relatively steady since last year, with roughly 9% indicating that they treat 3 or fewer and 24% indicating that they treat more than 20, this year, there was a shift toward treating a higher total weekly volume of patients. From 2023 to 2024, there were subtle changes across the board, but the number of respondents who reported treating 25 to 50 patients per week dropped from 27% to 19%, and the number who reported treating 100 or more patients increased from 22% to 29%. These numbers suggest that in order to balance profitability with the need to keep care competitively priced and accessible, many practices are electing to increase patient volume. However, not all practices are focused on increasing volume as a means to maintain or increase profit. "I haven't increased my patient volume," says Dean Kois, DMD, MSD, an instructor at the Kois Center and a prosthodontist with a private practice in Seattle, Washington. "My focus has always been on delivering high-quality care to patients who value it. Being a better clinician, one that can deliver comprehensive care, is more profitable than just seeing more patients. It can also be more fulfilling to provide high-level care than to scale for volume. Both approaches can work; it just depends on your goals as a clinician."

When examining practices' sources of new patient referrals, the survey data reveals that the most significant overwhelmingly continues to be established patients, with little shift in the numbers since last year. Regarding the marketing channels that practices employ, the use of email, print ads, and direct mail stayed relatively the same from 2023 to 2024; however, there was an increase in the percentage of respondents who indicated that they use websites (64% to 71%) as well as social media (47% to 51%) and online ads (15% to 19%). "Having a great website is crucial because referred patients often check it as their next step," Levin advises. "If you are going to pay for marketing, try to avoid a long-term contract and be sure to track your return on investment." Although having a website can be seen as a necessity in this day and age, the percentage of respondents who reported that they use chat bots fell from 8% in 2023 to 4% in 2024, which may indicate that this functionality isn't necessary for a dental practice's website to be successful.

Undeniably, the effect of dental support organizations (DSOs) represents one of the more significant changes to the business of dentistry in modern times. Joining a DSO can provide many benefits for practitioners who are less interested in the business aspects of practice and want to focus more on patient care, those who are looking to sell their practices, those who seek greater collaboration or a better work-life balance, and more. Interestingly, although the percentage of survey respondents who indicated that they were not at all open to joining a DSO decreased from 2022 to 2023, from 2023 to 2024, that number increased from 49% to 62%-a shift of 13%. Meanwhile, the percentage of respondents who indicated that they were somewhat open to the idea dropped from 35% to 25%. Taken together, these two data points suggest a cooling of dentists' interest in DSOs if not a growing negative sentiment. "My decision to not join a DSO involved more than just financial considerations," Kois explains. "It was also shaped by factors like my geographical location, my personal goals, and my personality. I have the patients, the schedule, the team, and the professional fulfillment that I've always wanted, but it took years to build. Dentistry is a long game; it takes time to develop the knowledge, skills, and business acumen to provide top-level care, create efficiency at the chair, and maximize profitability." Although joining a DSO isn't for everyone, the American Dental Association found that DSO dentists were more optimistic about the current economic conditions, with 41% reporting that they felt confident about their practices as opposed to 24% of non-DSO dentists.1

Clinical Care

From 2023 to 2024, many of the key clinical trends either remained stable or evolved only slightly. There was no notable change in the reported number of direct restorative or crown and bridge cases performed monthly, nor was there any change in the reported number of endodontic procedures performed. Regarding orthodontics, attitudes toward remote treatment remained unchanged from 2023 to 2024, with 63% of respondents still indicating that clear aligner therapy should be managed in person. The percentage of respondents who offer sedation dentistry has also held steady at around 24%. When it comes to bleaching, all of the treatments remained popular, but from 2023 to 2024, there were slight decreases in the percentages of respondents who reported offering Go trays (5%) and strips (6%) but an increase in those who reported offering chairside whitening (8%), which is now being offered by more than half of the respondents (52%).

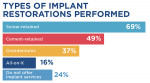

The trends related to implant treatment remained stable from 2023 to 2024 as well. There was no significant change in the percentage of respondents who reported placing any number of implants per month. For example, those who indicated that they place 6 to 10 implants per month held steady at 10%. There was also no significant change in the percentage of respondents who reported that they do not place any implants, which was 49%.

Regarding the types of implant-supported restorations being placed, from 2019 to 2022, the survey data indicated that the percentage of responding dentists who placed screw-retained restorations increased by 10% (61% to 71%) and the percentage who placed cement-retained restorations decreased by 15% (66% to 50%). Those are dramatic changes. However, over the past 2 years, those numbers have stabilized, with 69% of respondents currently reporting that they place screw-retained restorations and 49% reporting that they place cement-retained ones. Even with the development of newer angulated abutments and screw systems, there may always be a few cases where cement retention is preferred, but what accounts for this seeming stagnation in the adoption of screw retention? "Until screw retention becomes the standard for everything, from full-arch restorations to single crowns, the delay in adoption can mostly be attributed to unfamiliarity with modern components and scanning protocols," suggests Johnson. "Cement retention was once necessary because of misaligned screw channels and complex impression procedures. However, with today's advanced scanners and angled abutments and hex drivers, those challenges are largely obsolete."

One clinical area that saw a shift in the survey was the practice of sleep dentistry. From 2023 to 2024, there was a 6% increase in the percentage of respondents who indicated that they do not treat sleep apnea, with a matching 6% decrease in those who indicated that they treat 1 to 5 patients per month. This appears to indicate that sleep dentistry is becoming more specialized. "The shift away from treating sleep apnea is driven by reduced reimbursements, rising laboratory costs, and increasingly complex medical billing and insurance requirements-all of which make the process less financially viable and accessible for most general dentists," explains Steven Lamberg, DDS, a diplomate of the American Board of Dental Sleep Medicine and private practitioner in Northport, New York. "In addition, the influx of commercial interests into dental sleep education has created confusion with conflicting protocols and workflows. Even many large dental franchises are not set up to overcome these difficult barriers to providing predictable treatment outcomes."

The execution of complex treatment plans has always been major contributor to the success of dental practices. In 2024, survey respondents indicated a drop in patient acceptance of complex treatment plans, with approximately 54% reporting that the majority of their proposals are accepted. This is the first time that this number has fallen below 57% since the survey began in 2019. Only 11% of the respondents reported acceptance rates greater than 80%, and 22% indicated that less than 25% of their proposals are accepted. "Inflated overhead combined with patient hesitancy toward large treatments, is concerning," says Johnson. "Add in high interest rates and DSO corporatization, and independent practice owners have to be smarter than ever before." Because many more patients are generally unwilling or unable to pursue higher-cost, more definitive treatment, many clinicians are performing more transitional bonding procedures.

In other clinical trends, the percentage of respondents who reported milling restorations in house decreased slightly from 14% in 2023 to 12% in 2024, the percentage who reported that they 3D print permanent restorations in house increased from 2% in 2023 to 4% in 2024, and the percentage who reported communicating face-to-face or by phone with the laboratory on the majority of their complex cases increased from 33% in 2023 to 36% in 2024. In a much larger shift, the percentage of respondents in 2024 who reported that they prefer to avoid the use of teledentistry was 44%-a 12% increase from 22% in 2023. As more and more time passes since the COVID-19 pandemic, many practices may be viewing the value of remote appointments with more scrutiny.

Purchasing and Technology Adoption

In 2024, more than half of the respondents (55%) continue to work with 1 to 3 distributors or dealers, and participation in group purchasing organizations and buying groups remains steady at around 25%. The percentage of respondents who indicate that clinical research is very important in their purchasing decisions continues to hover around 80%, and most rank the recommendations of key opinion leaders and study club resources over those of other sources, such as advertisements, dealer representatives, and dental publications.

Although the websites of manufacturers and dealers remained the online services most used for purchasing by this year's respondents, from 2023 to 2024, there was a 5% increase in the percentage of respondents who indicated using Amazon. "Like many, I rely on Amazon for many of my everyday purchases, and I've increasingly turned to it for dental supplies as well," explains Johnson. "I've discovered a growing selection of alternative instruments, such as polishing brushes and laboratory burs. I've also begun ordering from various implant component websites, which have become valuable resources for finding specialized implant abutments and screws. However, as much as I still rely on traditional dental supply channels for most materials, the modern GPO model appears to be gaining ground."

One well-known approach to increasing practice profitability and growth is through the implementation of new technology. While the percentages of respondents who reported spending 15%, 20%, or 30% or more of their yearly practice budgets on purchasing new technology all decreased from 2023 to 2024, the percentage of respondents who reported spending 10% or less of their yearly practice budgets on purchasing new technology increased 10% from 48% in 2023 to 58% in 2024. This likely indicates that the economy resulted in practices tightening their purse strings, but well-thought-out investments in appropriate technology can increase profitability. "Although we're careful about our budget, investing in technology has boosted our profitability, allowing us to continually reinvest," says Duplantis. "If a technology isn't providing a return on investment, it's important to reassess."

According to Johnson, investments in new technology should not only provide a financial return but also enhance clinician work satisfaction and patient experience. "Sometimes, technology may just break even financially, but the intangible rewards keep you going," he says.

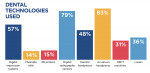

From 2023 to 2024, the percentages of respondents who reported that they use air-driven handpieces (83%), electric handpieces (48%), and cone-beam computed tomography (CBCT) machines (31%) in their practices remained steady. The percentage of respondents who reported that they use digital radiography sensors increased from 75% to 79%, the percentage of those who reported that they use 3D printers increased from 12% to 15%, and those who reported that they use lasers decreased from 41% to 36%. "Lasers have plateaued at a 4% market share, and I don't expect that to grow," says Levin.

After the percentage of respondents who reported using digital impression systems underwent significant year on year increases from 37% in 2020 to around 50% in 2022, it dropped slightly to 48% in 2023, indicating a brief pause in the rate of adoption. However, from 2023 to 2024, the data indicates that the percentage of respondents who use digital impression systems surged from 48% to 57%-an increase of almost 10%. "With digital impression systems, we've seen significant improvements in efficiency, largely due to the technology's ability to consistently deliver high-quality results," explains Duplantis. "Accuracy is no longer a concern when incorporating intraoral scanners, and with the price point coming down, the decision to invest has become easier."

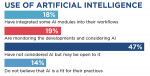

When compared with previous years, respondents to Inside Dentistry's 2023 survey were more critical regarding their attitudes toward the use of dental technologies powered by artificial intelligence (AI). However, from 2023 to 2024, the percentage of respondents who reported that they have integrated some AI modules into their workflows increased significantly from 9% to 18%. Although the percentage of those who indicated that they were not considering AI products but may be open to them (47%) and the percentage of those who indicated that AI is not a fit for their practices (14%) essentially remained the same from 2023 to 2024, the percentage of those who indicated that they were monitoring the developments in AI and considering it decreased from 26% to 19%. When considered together, this data seems to indicate that those who had already made up their minds last year remained unchanged but that many of those who were considering AI moved on to adopting it. "AI is still in the early adopter phase for diagnostics," says Duplantis. "Although I can confirm that it's beneficial for any practice, we must still rely on our clinical acumen before making diagnoses. In time, I expect AI will be an integral part of most dental practices, but for now, teams are still determining how it fits into their workflows."

"As with all things new, especially revolutionary leaps like AI, a significant amount of trust must accrue before our actions (and reactions) turn to instinct," says Johnson. "The first quarter of the 21st century was marked by substituting analog methods with digital alternatives in dentistry, like replacing traditional impressions with intraoral scanners. Looking ahead, I think the next 25 years will see technology bring even more control to our procedures and instill even greater confidence in our outcomes."

Find Your Own Path

With rampant inflation and rising overhead, not to mention the ongoing effects of other factors, such as staffing shortages, stagnating insurance rates, and greater competition from DSOs, 2024 was a tough year for many dentists. Nonetheless, practices found new ways to maintain and increase profitability, including by offering more flexible payment options, increasing patient volume, improving their marketing efforts on their websites and through other channels, expanding treatment options, implementing new technologies, and more. One thing that is important to remember about trends in dentistry is that they are just that: trends. Although paying attention to what others in the profession are doing is certainly worthwhile, what is right for one practice-or even for the majority of them-is not necessarily right for all of them. Today's dentists have many resources at their disposal to help them build thriving practices for the future. The key is for each practice to select the most appropriate options for its development and then work to maximize their impact.

Reference

1. ADA Health Policy Institute. Economic Outlook and Emerging Issues in Dentistry: 3rd Quarter, 2024. ADA website. https://www.ada.org/-/media/project/ada-organization/ada/ada-org/files/resources/research/hpi/sept2024_hpi_economic_outlook_dentistry_main.pdf. Published September 1, 2024. Accessed November 12, 2024.